How Trump’s tariffs increase construction material costs and home insurance premiums. Secure accurate rebuild coverage with Gonzalez Insurance’s customized policies. Evaluate your policy today!

The new tariffs imposed by the Trump administration, especially the sizeable increases targeting China and others in 2025, have caused disruption in the U.S. economy. There are many industries affected, but the construction industry will be among the hardest hit by significant tariffs. This surge in material costs isn’t just straining builders’ budgets; it’s creating a domino effect that’s now crashing into homeowners’ wallets through dramatically rising insurance premiums. The dream of affordable housing and manageable homeownership costs is becoming increasingly elusive under this weight.

The Tariff Hammer Falls on Construction

China has long been a primary supplier of essential construction materials to the United States. In 2018 alone, the U.S. imported a staggering $17.5 billion worth of construction goods from China (U.S. Census Bureau). The initial rounds of tariffs under President Trump began disrupting this flow years ago. The impact was immediate and severe: steel prices, a fundamental building block for countless projects, soared by up to 25% following their implementation (SteelBenchmarker).

Fast forward to 2025, and the pressure has intensified dramatically. In April 2025, President Trump introduced a sweeping 10% baseline tariff on imports from all countries. For China, this came on top of existing measures: a further 34% was piled onto the 20% announced just the month before, resulting in a crushing total tariff rate of 54% on Chinese goods. While Mexico and Canada received exemptions from the April blanket tariff, they still faced a significant 25% tariff on non-USMCA goods like steel and aluminum announced in March. Given the heavy U.S. reliance on these three nations for critical materials like lumber and steel, the disruption to supply chains and costs has been profound.

Construction Costs Skyrocket

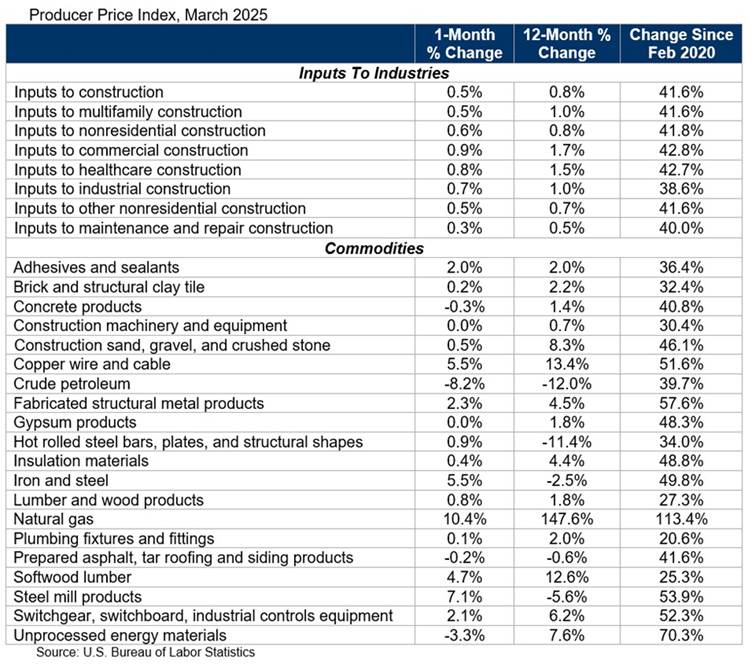

The data paints a clear picture of escalating pressure:

- Consistent Increases: March 2025 saw a third consecutive month of increase in construction input prices (ABC examination of BLS data). Nonresidential prices increased 0.6% month over month, while residential input prices rose 0.5%. Both industries saw costs up 0.8% year after year.

- Panic Buying & Preemptive Spikes: Even before the April 2025 tariffs took effect, contractors rushed to stockpile materials, causing a sharp 1.4% spike in input prices in January 2025 – the largest monthly increase in two years (Construction Dive).

- Builder Burden: The National Association of Home Builders (NAHB) reports that 60% of builders surveyed have already seen suppliers hike material prices due to tariffs. Their estimates are alarming: tariffs on steel, aluminum, and other building materials could inflate the cost of constructing a typical single-family home by $9,200 to $10,900.

- Crisis Compounded: This hits an industry already struggling with a historic housing affordability crisis fueled by years of underbuilding after the Great Recession and a severe lack of inventory. Projects initiated to alleviate this shortage are now facing severe budget overruns before they even break ground.

- Confidence Crumbles: Unsurprisingly, homebuilder confidence plummeted for the second straight month in March 2025, hitting 39 – its lowest level since August of the previous year. Homebuyer traffic also dwindled to multi-year lows (NAHB).

The Insurance Premium Domino Effect

The pain doesn’t stop at the construction site. The cost to rebuild or fix a harmed property is the basic tenet driving homeowner insurance. The cost to insure against the loss of lumber, steel, roofing materials, drywall, windows, and plumbing fixtures necessarily follows when tariffs increase their price.

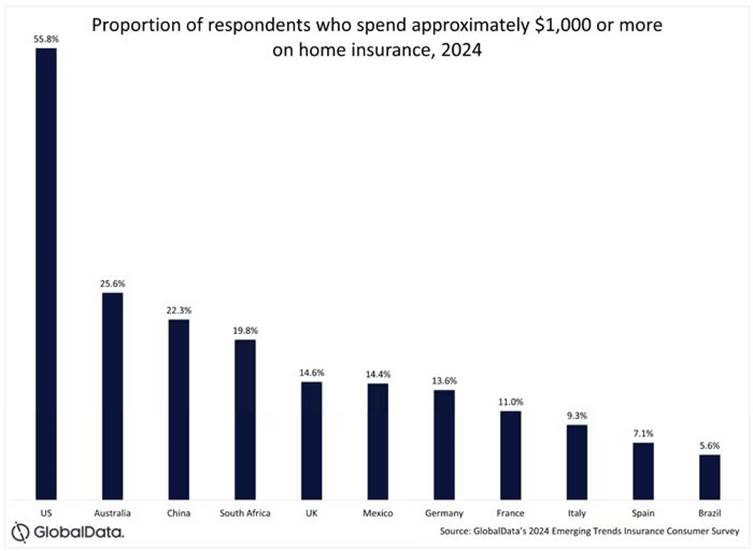

- Already High Premiums: U.S. consumers already bear the highest home insurance costs among surveyed nations (GlobalData). A stark 55.8% of Americans pay over $1,000 annually, compared to just 14.6% in the U.K. paying the equivalent amount.

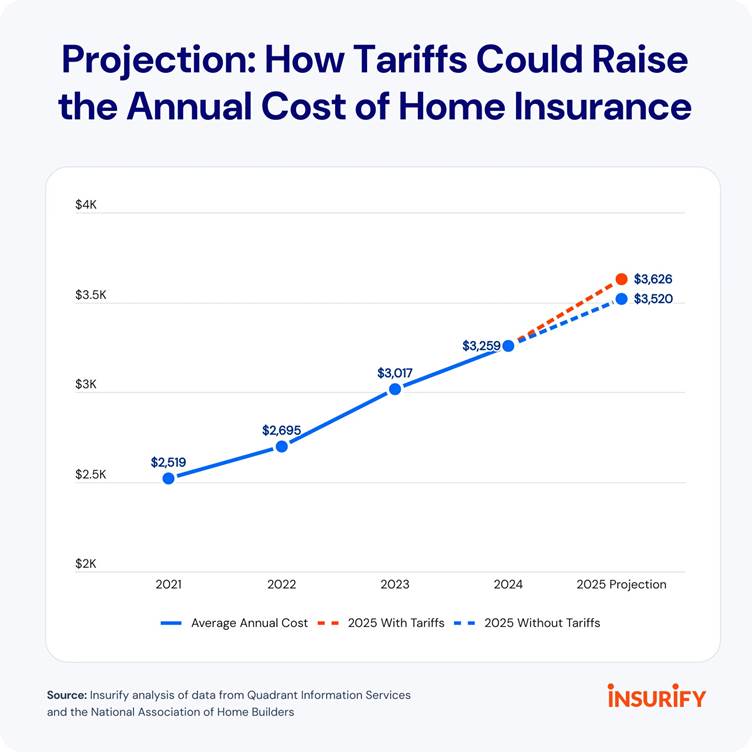

- Rebuild Costs Set to Soar: The tariffs directly impact the “replacement cost” calculations insurers use to set premiums. As the cost of materials and labor needed to rebuild a home increases, insurers must adjust their premiums upwards to maintain adequate reserves to cover potential claims.

- Projected Acceleration: Insurify, an insurance comparison company, projects that the tariff-induced surge in construction costs will force a significant acceleration in home insurance premium increases. Their analysis forecasts that by the end of 2025, home insurance costs will rise by 11%, a rate 3% point higher than what would be expected without the tariffs. This means hundreds of dollars in additional annual costs for the average homeowner.

The Bottom Line for Homeowners

President Trump’s tariffs, intended to reshape trade dynamics, are having profound and costly unintended consequences for everyday Americans. They are:

- Driving up the cost of new homes, exacerbating an existing affordability crisis, and pricing more buyers out of the market.

- Making home repairs and renovations significantly more expensive, straining household budgets for maintenance and improvements.

- Directly causing a sharp rise in homeowners insurance premiums, adding a substantial, recurring financial burden on top of mortgage payments and property taxes.

With construction and insurance costs going up, it’s really important to make sure your home is well-protected. The usual insurance coverage might not be sufficient anymore. If the cost to replace your home was figured out a year ago, it might not cover everything today; this could leave you underinsured if something bad happens.

Conclusion

Unquestionably, the ripple effects of tariffs on steel, wood, and innumerable other building materials include increased construction costs, more costly repairs, and invariably, more costly insurance premiums. Having a home insurance plan that truly reflects the present worth and special features of your property is not just advisable but rather vital in this climate of rising costs and higher risk.

Don’t risk being underinsured. At Gonzalez Insurance, we understand the complexities of today’s market. We go beyond generic quotes to create customized policies meticulously tailored to your specific home. We carefully evaluate:

- Your Home’s Unique Structure: From the foundation to the roof, considering materials, age, and special features.

- Accurate Reconstruction Value: Calculating the true cost to rebuild your home today, factoring in current material and labor expenses influenced by market dynamics like tariffs.

- Your Personal Circumstances: Whether you own a sprawling estate requiring specialized coverage or a suburban family home, we tailor your protection.

- Valuables Protection: We proactively identify and suggest coverage for special belongings like jewelry, art, or heirlooms that standard policies often undervalue or exclude.

With Gonzalez Insurance, you gain more than just a policy; you gain peace of mind. You can believe that we will do everything in our power to respect the aspect of security in your home, and if the unimaginable happens, you can be confident that you can reconstruct your life and your home as rapidly and as wholly as possible, without destructive financial setbacks.

Your most important asset merits the utmost careful safeguarding! Get in touch with Gonzalez Insurance today for a thorough assessment of your existing home insurance plan.

FAQs

1. So, how exactly are tariffs impacting construction costs?

A few reasons! But basically, tariffs on materials like steel and lumber are driving up the cost of everything from new houses to home repairs.

2. What kind of increase can I expect for my home insurance by the end of 2025?

Experts are predicting about an 11% jump in home insurance costs by late 2025, and a big reason for that is these tariffs.

3. How can Gonzalez Insurance actually help me with these higher costs?

We can take a good look at your current home insurance and create a custom plan to make sure you’re properly covered for today’s rebuilding costs, so you’re not caught off guard.