We know – auto insurance policies often seem like gibberish, but understanding the liability limit code can mean the difference between paying for everything out of pocket, and standing back while your insurance company pays all the bills.

What’s the liability limit code? You probably remember that at the top of your policy is a string of numbers, like this:

$15,000 / $30,000 / $5,000

Look familiar? You probably remember you had a bunch of options, and that some of them involved a higher monthly price for your insurance, and some others involved a lower monthly price.

It’s very likely you picked the one that got you the lowest rate on your insurance. That’s not unreasonable – if you don’t know what the liability limit code really means.

Here’s what the policy above will get you when it’s put to the test.

Let’s take a real-life scenario. It’s a hot summer day and you’re driving down the highway with your family on the way to the beach. You’ve just bought the new car and you’re tooling along at a brisk 58 miles an hour when your phone rings in your pocket with an annoying, persistent chirp.

You try to wrestle the phone out of your pocket to turn it off, and accidentally drop it in the process. Automatically, you look down to see where the phone fell – just as your car comes over a rise, revealing that traffic has come to a full stop shortly ahead.

You slam on the brakes, but it’s too late. Your car makes a crunch noise, your airbag is released, the windshield is smashed. There’s blood on your face and your ears are ringing. You spend the next few minutes frantically getting yourself and your family out of the car, and it isn’t until you’re all safely at the side of the road that you realize not only have you totaled your car – you’ve pushed a Lexus into a 2012 Mustang, and other people have been badly hurt.

You’ve caused a 5-car pile-up. 2 people are badly injured, and 3 have bruises and whiplash.

How will your car insurance handle this?

Injuries to Others

Your insurance covers $15,000 worth of damages to any one person, and $30,000 total for the injuries you cause per accident.

In this scenario, your insurance will cover $15,000 for the first person’s injuries, and $15,000 for the second person – but since those two total up to your maximum injuries per accident, $30,000, you’re out of insurance money to pay their bills.

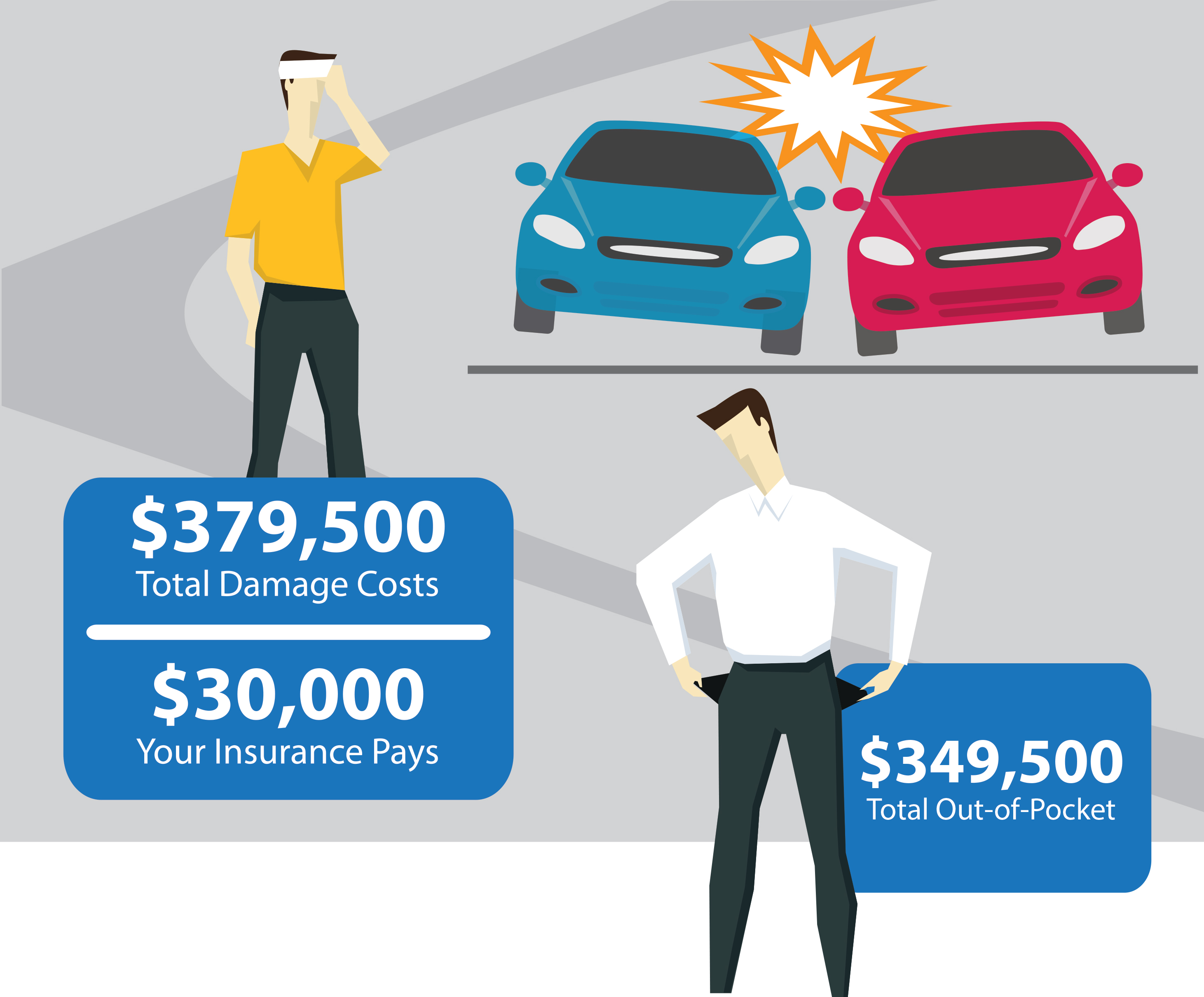

After a few days, you receive the following tally of the injuries to the other 5 people in the accident:

The total damages are $379,500 and you have coverage for $30,000. The rest of that money comes out of your pocket – and if you don’t happen to have the price of a decent-sized house lying around, everything you own will be going to auction to pay the bill.

Unfortunately, that’s the least of your worries.

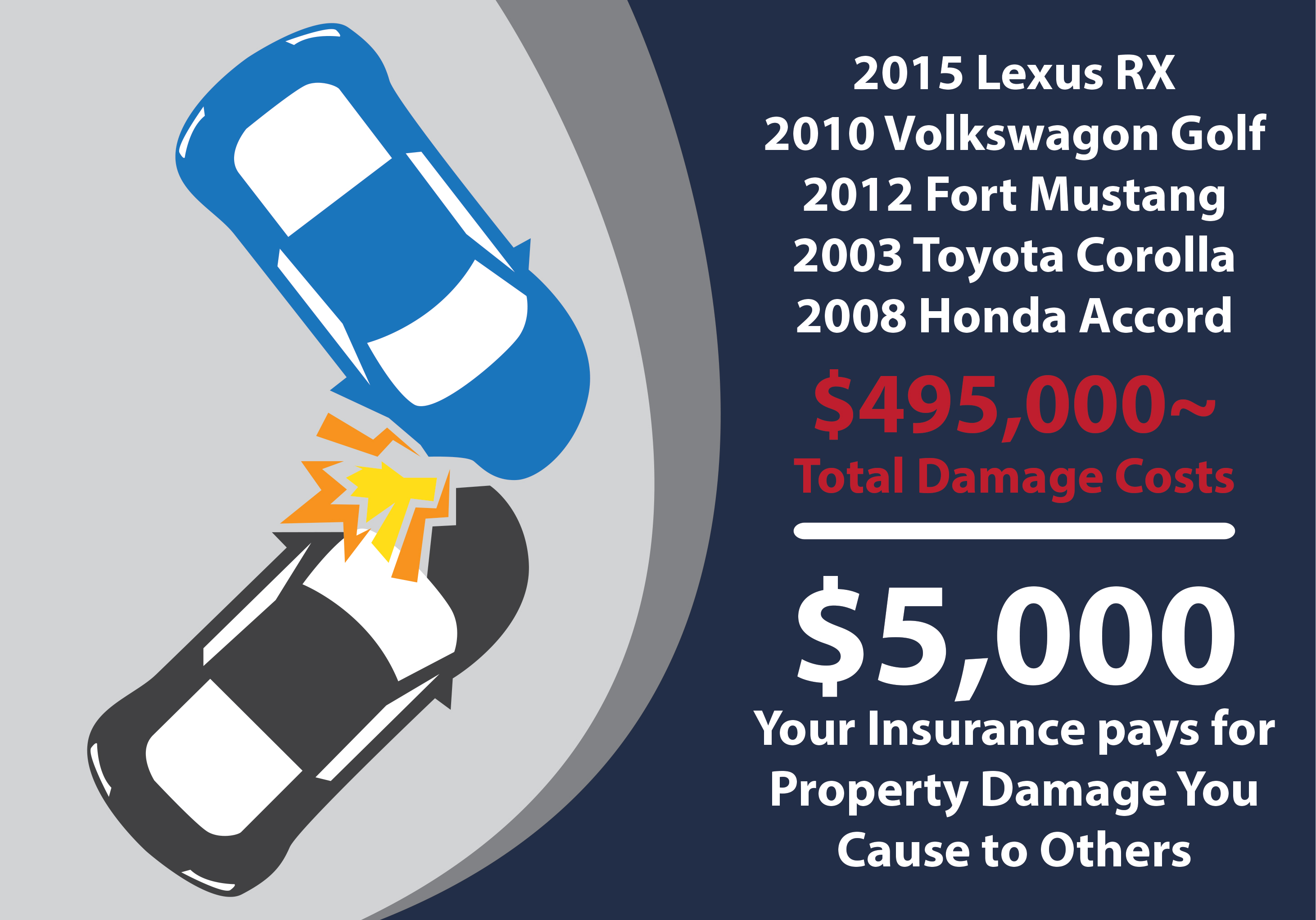

The last number on that policy is $5,000. This is all the money you have to cover the damages done to every vehicle in that accident.

Let’s say that only one of the vehicles in that accident was a luxury vehicle – the Lexus. The other vehicles were a 2010 Volkswagon Golf, a 2012 Ford Mustang, a 2003 Toyota Corolla, and a 2008 Honda Accord. Here’s the tally on the total damages you caused to these vehicles:

Just like the damages to others above – you are personally liable for all the costs above and beyond what your insurance covers. We’ve just put you in debt to the tune of nearly half a million dollars, for just one car accident.

That’s the bad news. Here’s the good.

You Can Avoid This

Those numbers are confusing, I know. And many insurance agents don’t properly explain. They only tell you the various prices of each plan, and naturally you pick the one that represents the lowest cost to you in that moment.

Here’s the important takeaway: you can cover an enormous amount of damages for a very small increase in the price of your policy. As just one example, you could bump the amount of your property damages to others to $65,000 – instead of that piddling $5,000 – for just a 15% increase in your rate.

What does that mean? Instead of paying $150 a month, you’d be paying $167.50.

It seems like a pretty small expense when compared to the price of that Lexus’ repairs, doesn’t it?

Similarly, raising your coverage for the injury you do to others is a small percentage increase for an immense amount of peace of mind. It’s well worth the additional cost to be certain that when a catastrophe happens, you won’t go bankrupt paying all the bills.

No One Plans for Disaster

No one ever wakes up in the morning thinking, “Today’s the day I’m going to cause a major accident!” Of course not. If you could possibly avoid that car crash, you would do it in a heartbeat.

Disasters aren’t planned. The best you can do is acknowledge that sometimes it comes unasked-for and without warning, and make sure you’re protected in case today is your day.