Rising risks for US short-term rental owners: injury lawsuits, costly damage, insurance gaps, complex regulations, income swings & neighbor conflicts. Protect your investment.

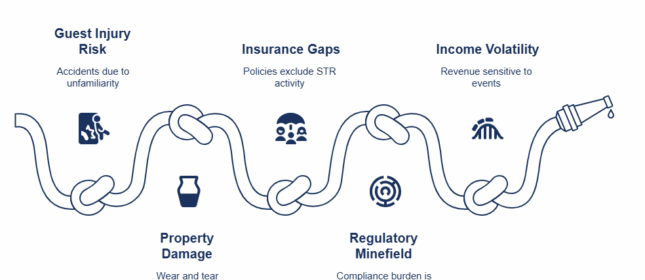

Dreams of converting a spare room, vacation home, or investment property into an income stream through platforms like Airbnb and VRBO have stoked the imaginations of legions of Americans. Short-term rentals (STRs) – properties let out for anything from overnight stays to a few weeks – provided guests with authentic experiences and hosts with lucrative returns. But the fact of the matter is that the situation has hugely changed for property owners. What used to look like an almost hands-off business is now considered not only a high liability sticky wicket – but one that has seen both liabilities ballooning over time and new ones popping up regularly. Hence, your short-term rentals might not be the asset you think they are. Here are seven well-considered reasons why they could be becoming a significant financial risk:

1. Heightened Risk of Guest Injury & Costly Lawsuits

- The Problem: High turnover of guests increases the probability of accidents because they don’t know the property and are therefore more prone to slips on stairways, falls in bathrooms, pool accidents, burns, or even allergic reactions.

- The Liability: Under US premises liability laws, property owners can be held financially responsible for injuries sustained by guests. In other words, lawsuits for payment of extensive hospital bills, costs of rehabilitation, lost wages, pain, and suffering have come upon property owners with hefty legal fees.

- The Financial Threat: One injury incident could blow up into hundreds of thousands, if not millions, in liabilities. Without the specific and adequate insurance coverage, the owners are putting themselves at risk of incurring a devastating personal financial loss. This risk is now formally mandated, as is the case in Massachusetts, where it requires a minimum liability coverage of $1,000,000 or more per rental property.

2. Accelerated Property Damage & Soaring Maintenance Costs

- Frequent Wear & Tear: Changing guests most of the time deteriorates faster the condition of furniture, appliances, and concrete flooring, walls, and even illumination fixture painting. Normal wear and tear is worsened.

- Accidental & Intentional Damage: Spills, broken items, and minor accidents are part of the deal. Worse, intentional damage due to unauthorized parties (“Airbnb parties”) could occur and cause extensive destruction that would warrant very costly repairs or replacements.

- Operational Expenses: STRs require continuous maintenance. The need for professional-grade cleaning between every guest, the need to constantly restock essentials (linens, toiletries, coffee), landscaping, and urgent response maintenance issues (plumbing leaks, appliance failures, WiFi problems) lead operational costs to be far higher than traditional long-term rentals.

3. Critical Insurance Gaps & Policy Violations

- The Major Pitfall: This is likely the most ignored and hazardous liability. Policies for regular homeowner’s insurance cover owner-occupied homes. Standard landlord insurance is meant for homes rented to long-term renters – usually 6+ month leases. Both often specifically exclude coverage for regular, short-term commercial rental activity.

- Severe Consequences: Your insurance company might reject the claim totally if a serious event like a guest-caused fire, a terrible injury lawsuit, or large damage occurs, claiming the conduct contravened the policy conditions. This makes the owner personally liable for all related expenses, which might be financially crippling.

- Platform Coverage Isn’t Enough: Although Airbnb or VRBO provides some “host protection,” these policies have low coverage limits, several exclusions, difficult claims procedures, and might not apply if the platform challenges liability. Therefore, platform coverage alone is insufficient. At most, they are additions; they are not the primary fix.

- Community Impact: It can even drive up insurance costs for neighbors; some insurers increase rates in areas with high STR density, fearing heightened risks such as potential fire/flood concerns or liability exposure.

4. Navigating a Complex Regulatory Minefield

- An Ever-Evolving Patchwork: STR regulations across the US are constantly evolving, with great variation in enforcement from place to place – states, counties, or cities, even individual neighborhoods or zoning districts.

- Compliance Burden: Owners must navigate a maze of potential requirements:

- Licenses & Permits: Many local jurisdictions require specific (and often expensive) business licenses or permits to operate lawfully.

- Zoning Restrictions: STRs may be banned altogether in certain neighborhoods or restricted to specific types of properties.

- Safety Codes: Safety codes may include very stringent requirements for fire extinguishers, smoke/CO detectors, egress windows, occupancy limits, and safety inspections.

- Taxes: The requirement to collect and pay various taxes (occupancy tax, sales tax, local tourism taxes) increases paperwork.

- HOA Restrictions: Even if your state allows for short-term rentals, your Homeowners Association (HOA) covenants could not allow short-term rentals at all or could place significant restrictions on short-term rentals (the minimum length of stay, the total number of guests allowed, rules surrounding noise, etc.)

- Costly Penalties: You may face severe daily fines for not complying with your HOA regulations, eviction of your guests, viable cease-and-desist orders that shut down your business, or liens could be placed against your property. Compliance requires you to stay on top of your HOA guidelines, sometimes even with legal help.

5. Unpredictable Income & Vacancy Volatility

- Inconsistent Cash Flow: STR revenue is quite sensitive to seasonality, local events (festivals, conferences), more general economic downturns, weather, and more competition. A significant event cancellation or a slump in the economy can ruin reservations.

- Frequent Vacancies: Long-term rentals give you a set rate each month, but short-term rentals, by their nature, have empty days. This can happen on workdays and in slow seasons, or when there is a time between bookings. So there are days with zero income to help pay for set costs like insurance costs, land taxes, HOA charges, power bills, and home loan payments.

- Financial Strain: Budgeting is challenging, and there could be serious cash flow issues if income is erratic. This could put the owner at risk of not being able to pay for basic expenses.

6. Strained Neighborhood Relations & Community Backlash

- Disruptive Behavior: Short-term guests, whether on vacation or reveling in a celebration, are generally less invested in preserving the peace of a community than those who live there long term. Which often results in the following complaints:

- Noise: Parties, late-night arrivals, loud gatherings.

- Parking: Congestion, blocking driveways, using guest spots.

- Trash & Litter: Improper disposal or overflowing bins.

- General Nuisance: Large groups, lack of respect for community norms.

- Negative Consequences: The long-term neighbors may lodge a formal complaint with the owner, the rental platform, legal authorities, and/or the HOA. These grounds lead to organized neighborhood opposition and calls for stronger regulation or outright banning of short-term rentals – and possibly to some diminution of sale prices to nearby homes.

7. Tenant Disputes & Relentless Management Burden

- Constant Conflict Resolution: Managing an STR is an ongoing customer service operation. Owners frequently deal with disputes over:

- Damage Claims: Determining responsibility and cost for broken items or property damage.

- Cleanliness & Condition: Guests disputing the property’s state upon arrival versus the listing description.

- Noise/Nuisance Complaints: Handling complaints from neighbors about your guests’ behavior.

- Booking Issues: Managing cancellations, reservation changes, and demands for refunds.

- Significant Time Commitment: Resolving the dispute is a very time-consuming matter. It entails continuous communication most times across various time zones, gathering evidence such as photographs and messages, engaging in the platform’s mediation processes, and occasionally handling the threats of litigation. For the owners, especially those who are managing their properties from different locations or those with multiple listings, that weight often compels the hiring of a property manager, which further detracts from potential profits.

Conclusion

The short-term rental landscape in the US is increasingly complex and risky. The liabilities – from lawsuits and damage to insurance gaps, regulations, income swings, and neighbor issues – demand serious consideration and proactive protection.

The essential step? Standard insurance won’t cut it. Secure specialized short-term rental insurance to cover the unique commercial risks of this business.

While property owners face significant STR risks, tenants also need protection for their belongings and liability. If you rent an apartment or home, unforeseen events like theft, fire, or a guest injury can lead to major financial loss.

Gonzalez Insurance can help. We customize renters’ insurance policies that cover your personal property and protect you from liability claims. If you don’t have a renter’s policy – or are unsure what it covers – call Gonzalez Insurance today. Discover how affordable peace of mind can be.

FAQs

1. Why are short-term rentals becoming a bigger headache for property owners?

From guest injuries and lawsuits to property damage and confusing regulations, short-term rentals now have more financial risks than ever.

2. What’s the biggest insurance mistake short-term rental owners make?

Most owners mistakenly assume their regular homeowner’s insurance will cover commercial rental activities, leaving them dangerously unprotected.

3. How can I, as a renter, protect myself from financial loss?

If you’re a renter, Gonzalez Insurance can help you find an affordable renters’ insurance policy to protect your personal belongings and cover liability claims.